A sustained rise in the average price of goods and services over time in an economy is referred to as inflation. The Consumer Price Index (CPI), which tracks changes in the costs of a selection of goods and services that are typically purchased by households, is used to measure it.

When the amount of money in circulation increases and the purchasing power of money decreases, inflation occurs. This is so because an increase in the amount of money in circulation raises prices by increasing demand for goods and services. Supply-side factors like a decline in the availability of resources, a reduction in the supply of goods and services, and an increase in production costs are additional factors that cause inflation.

An economy can be affected by inflation in both positive and negative ways. One way low and steady inflation can help the economy grow is by giving people and businesses a stable price environment that encourages spending and investment. On the other hand, rapid and unpredictably rising inflation can result in a decline in economic activity and a reduction in the purchasing power of money, which lowers household standards of living.

Cost-push inflation, demand-pull inflation, and stagflation are a few of the different types of inflation. Cost-push inflation happens when prices rise as a result of rising production costs. When there is a rise in demand for goods and services, higher prices result from demand-pull inflation. When there is both inflation and a decline in economic activity, the term “stagflation” is used.

Examples of inflation include:

- High oil prices, increased government spending, and a decline in the supply of goods and services caused the United States inflation in the 1970s and 1980s, which was high and unstable.

- When the government printed too much money to cover the costs of World War I, it caused hyperinflation and the collapse of the economy in Germany during the 1920s.

- Venezuela experienced high and unpredictable inflation in the 2010s as a result of a decline in the availability of resources, a reduction in the supply of goods and services, and an increase in the cost of production.

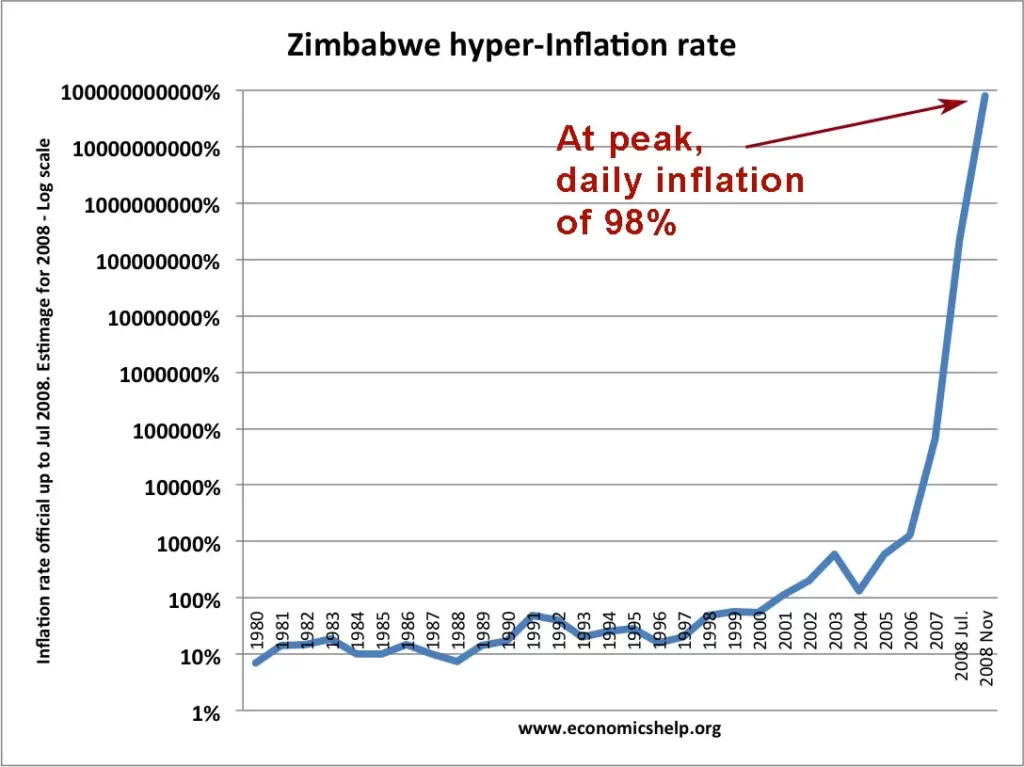

Zimbabwe Hyperinflation

From the late 1990s to 2009, Zimbabwe experienced hyperinflation, a period of extremely high inflation. With a peak rate of 89.7 sextillion percent per month in November 2008, it was one of the most extreme hyperinflations ever documented in human history.

A number of factors, including the nation’s political and economic crisis, the rapidly expanding black market, the decline in the value of the Zimbabwean dollar, and the government’s monetary policies, contributed to Zimbabwe’s hyperinflation. To cover its costs, including its military operations in the Democratic Republic of the Congo, the government had printed large amounts of money, but this only served to fuel inflation by rapidly expanding the money supply.

In Zimbabwe, the effects of hyperinflation were disastrous. People now find it difficult to afford even the most basic necessities as a result of the sharp rise in the cost of goods and services. The Zimbabwean dollar’s value fell to the point where it was almost worthless. Savings were lost, and the economy was left in ruins. Although the economy was stabilized by the government’s introduction of the US dollar, many people continued to experience the effects of hyperinflation for years to come.

Zimbabwe’s hyperinflation serves as a cautionary tale about what can occur when governments improperly manage their economies and monetary policies. It also emphasizes how crucial sound monetary and fiscal policies are to preserve a strong and stable economy.

Conclusion

Finally, inflation is an important economic factor that can have both positive and negative effects. It may result in economic expansion and higher purchasing power, but it may also have the opposite effect, lowering purchasing power and weakening the economy. In order to keep inflation in check, it is crucial for governments and central banks to monitor inflation levels and implement strong monetary policies. While some nations, such as Zimbabwe, have experienced hyperinflation, most developed nations have been able to maintain moderate levels of inflation by utilizing a variety of tactics and tools. Understanding inflation is crucial for everyone, including consumers, businesses, and policymakers, as it can have an impact on a number of economic factors and ultimately determine how well-off a nation’s citizens are.