Investing in the stock market is a growing trend in Nepal, and buying shares has become easier with the availability of online trading systems. This guide will walk you through the process of buying shares in Nepal, making it simple and user-friendly, even for beginners.

Step 1: Open a TMS Account

Before you can buy or sell shares, you need a TMS (Trade Management System) account. This account is provided by your stock broker. There are numerous licensed brokers in Nepal, and once you have selected one, they will give you a TMS login URL along with your Username and Password.

Step 2: Login to the TMS Dashboard

Once you receive your login credentials, visit the URL provided by your broker. Enter your username and password, and you’ll be directed to the TMS dashboard. This is where you’ll manage your trades.

Step 3: Know the Market Hours

The stock market in Nepal operates from Sunday to Friday:

- Sunday to Thursday: 11:00 AM to 3:00 PM

- Friday: 11:00 AM to 1:00 PM

You can only place buy or sell orders during these hours.

Step 4: Add Funds to Your TMS Account

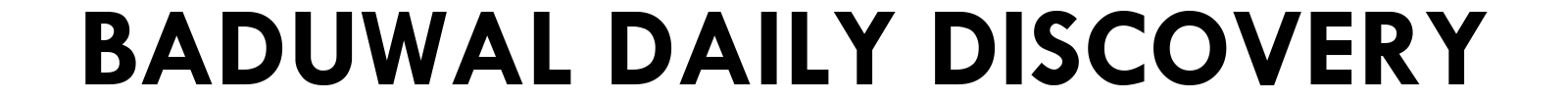

Before buying shares, you need to deposit money into your TMS account, which is called “Collateral.” Here’s how to do it:

- On the left-hand side of the TMS dashboard, click on Fund Management.

- Then select Collateral Management and click on Load Collateral.

This allows you to deposit money that will be used for buying shares. You can add funds using the following methods:

- IMEPay

- ConnectIPS

- Your linked bank (e.g., Global IME Bank)

Choose your preferred payment method, enter the amount, and add any necessary remarks. Once you’re ready, click Submit. You can check if the funds have been added by viewing the Client Fund Transfer History section, and the balance will also reflect in the Collateral Section.

Step 5: Buy Shares

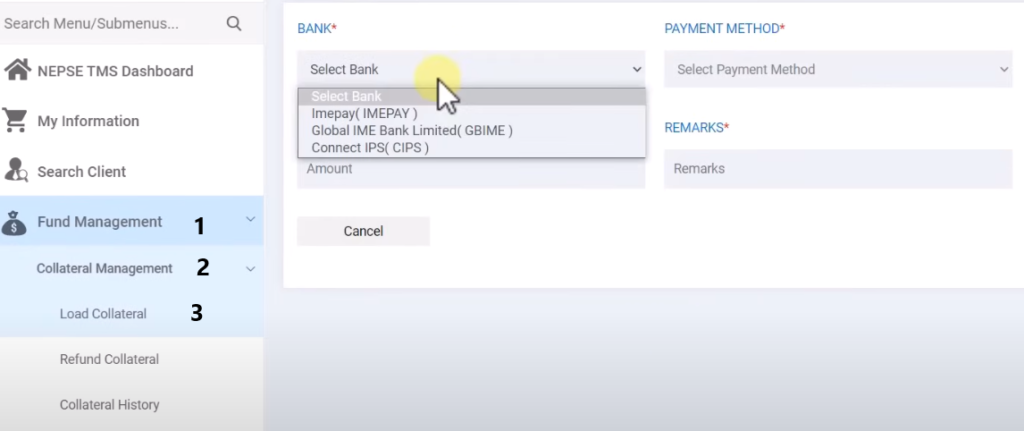

Now comes the exciting part—buying shares! Follow these steps:

- Go to Order Management and select Buy/Sell.

- Click on Buy.

- In the Symbol field, enter the name or symbol of the company whose shares you want to buy. For instance, if you want to buy shares of Sunrise Bank Limited, you would type SRBL in the symbol field.

You’ll see a table showing the Top 5 Buy and Top 5 Sell orders, which indicate the current prices at which people are buying and selling shares.

- In the Quantity field, enter the number of shares you wish to buy.

- In the Price field, enter the price at which you want to buy the shares. Let’s say you want to buy 11 shares of Sunrise Bank Limited (SRBL) at Rs.178 per share. The total cost would be Rs.1,958.

Ignore the “Validity” and “Valid Till” fields, and simply click Buy.

Step 6: Check the Status of Your Order

Once you place your buy order, it will appear in your Order Book. If you’re buying shares at the market price, the transaction is likely to be completed almost instantly. You can refresh the page to see if the order has been executed.

To confirm the purchase:

- Go to Order Management and click on Daily Order Book.

- Select Completed to check the status of your order. If the shares are listed there, it means you have successfully purchased them.

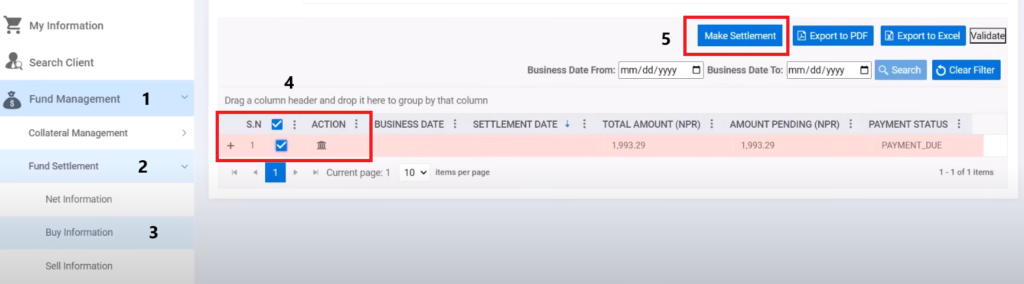

Step 7: Make the Payment

After buying shares, you’ll need to settle the payment, but this can only be done once the market closes. Here’s how:

- Go to Fund Management and select Fund Settlement.

- Click on Buy Information where you’ll see a list of your purchased shares along with the payment due.

- Select the shares for which payment is due and click on Make Settlement.

You’ll be given two options for payment:

- Collateral Payment – Use the funds you’ve already loaded as collateral.

- EOD Pay In – Pay using the funds in your bank account.

Since you’ve already loaded collateral, choose Collateral Payment, enter the amount, and click Make Payment.

Step 8: Wait for Shares to Reflect in Mero Share

After you’ve made the payment, you might wonder when the shares will show up in your Mero Share account. Typically, it takes 2-3 days for the shares to be credited to your account. Once they appear in Mero Share, the process is complete!

We hope this guide has made the process of buying shares in Nepal clear and easy to follow. Remember, stock trading requires patience, and it’s important to do your research before making any investment. Stay updated as we will regularly update this guide with the latest changes and improvements.

Video Guide:

FAQs

1. What is a TMS Account, and why do I need it?

A TMS (Trade Management System) account is an online platform provided by stock brokers in Nepal. It allows you to buy and sell shares on the Nepal Stock Exchange (NEPSE). Without a TMS account, you cannot trade shares.

2. How do I open a TMS account?

To open a TMS account, you need to select a licensed broker in Nepal. They will help you set up the account and provide login credentials, including the TMS URL, username, and password.

3. What are the stock market hours in Nepal?

The Nepal stock market operates from Sunday to Friday:

- Sunday to Thursday: 11:00 AM to 3:00 PM

- Friday: 11:00 AM to 1:00 PM You can only place buy or sell orders during these hours.

4. How do I add money to my TMS account?

To add money to your TMS account, go to Fund Management > Collateral Management > Load Collateral. You can deposit funds through IMEPay, ConnectIPS, or your linked bank account.

5. How do I buy shares in Nepal?

After adding funds, go to Order Management > Buy/Sell. Select “Buy,” enter the symbol of the company you want to purchase, enter the quantity of shares, set your price, and click Buy. You can see the status of your order in the Order Book.

6. What happens after I buy shares?

Once you place your order and it is successfully executed, the shares will show up in your Daily Order Book under Completed. You must settle the payment after the market closes by going to Fund Management > Fund Settlement > Buy Information and making the necessary payment.

7. When will the shares be visible in my Mero Share account?

It typically takes 2-3 days for the shares to appear in your Mero Share account after the transaction has been settled.

8. Can I cancel a buy order?

Yes, you can cancel a buy order if it has not been executed yet. Go to your Order Book and cancel the pending order before it gets matched with a seller.

9. What is the minimum number of shares I can buy?

In Nepal, the minimum order is usually 10 shares, though this can vary for specific companies or IPOs.

10. What payment methods are available for adding funds to my TMS account?

You can load funds through IMEPay, ConnectIPS, or directly from your linked bank account.